Intel To Wind Down Optane Memory Business – 3D XPoint Storage Tech Reaches Its End

It appears that the end may be in sight for Intel’s beleaguered Optane memory business. Tucked inside a brutal Q2’2022 earnings release for the company (more on that a bit later today) is a very curious statement in a section talking about non-GAAP adjustments: In Q2 2022, we initiated the winding down of our Intel Optane memory business. As well, Intel’s earnings report also notes that the company is taking a $559 Million “Optane inventory impairment” charge this quarter.

Beyond those two items, there is no further information about Optane inside Intel’s earnings release or their associated presentation deck. We have reached out to company representatives seeking more information, and are waiting for a response.

Taking these items at face value, then, it would seem that Intel is preparing to shut down its Optane memory business and development of associated 3D XPoint technology. To be sure, there is a high degree of nuance here around the Optane name and product lines here – which is why we’re looking for clarification from Intel – as Intel has several Optane products, including “Optane memory” “Optane persistent memory” and “Optane SSDs”. None the less, within Intel’s previous earnings releases and other financial documents, the complete Optane business unit has traditionally been referred to as their “Optane memory business,” so it would appear that Intel is indeed winding down the Optane business unit, and not just the Optane Memory product.

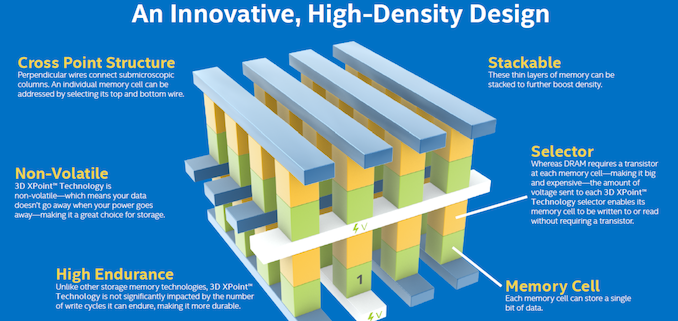

Intel, in turn, used 3D XPoint as the basis of two product lineups. For its datacenter customers, it offered Optane Persistent Memory, which packaged 3D XPoint into DIMMs as a partial replacement for traditional DRAMs. Optane DIMMs offered greater bit density than DRAM, and combined with its persistent, non-volatile nature made for an interesting offering for systems that needed massive working memory sets and could benefit from its non-volatile nature, such as database servers. Meanwhile Intel also used 3D XPoint as the basis of several storage products, including high-performance SSDs for the server and client market, and as a smaller high-speed cache for use with slower NAND SSDs.

3D XPoint’s unique attributes have also been a challenge for Intel since the technology launched, however. Despite being designed for scalability via layer stacking, 3D XPoint manufacturing costs have continued to be higher than NAND on a per-bit basis, making the tech significantly more expensive than even higher-performance SSDs. Meanwhile Optane DIMMs, while filling a unique niche, were equally as expensive and offered slower transfer rates than DRAM. So, despite Intel’s efforts to offer a product that could crossover the two product spaces, for workloads that don’t benefit from the technology’s unique abilities, 3D XPoint ended up being neither as good as DRAM or NAND in their respective tasks – making Optane products a hard sell.

As a result, Intel has been losing money on its Optane business for most (if not all) of its lifetime, including hundreds of millions of dollars in 2020. Intel does not break out Optane revenue information on a regular basis, but on the one-off occasions where they have published those numbers, they have been well in the red on an operating income basis. As well, reports from Blocks & Files have claimed that Intel is sitting on a significant oversupply of 3D XPoint chips – on the order of two years’ of inventory as of earlier this year. All of which underscores the difficulty Intel has encountered in selling Optane products, and adding to the cost of a write-down/write-off, which Intel is doing today with their $559M Optane impairment charge.

This is breaking news and will be updated with additional information as it becomes available

Read MoreAnandTech